Introduction:

In today’s fast-paced digital world, banking has undergone a significant transformation. Gone are the days of long queues and tedious paperwork. With the advent of technology, banks have embraced digital platforms to provide their customers with convenient and efficient banking services. One of the key elements driving this transformation is the focus on user interface (UI) and user experience (UX) design.

UI/UX Design in Modern Banking:

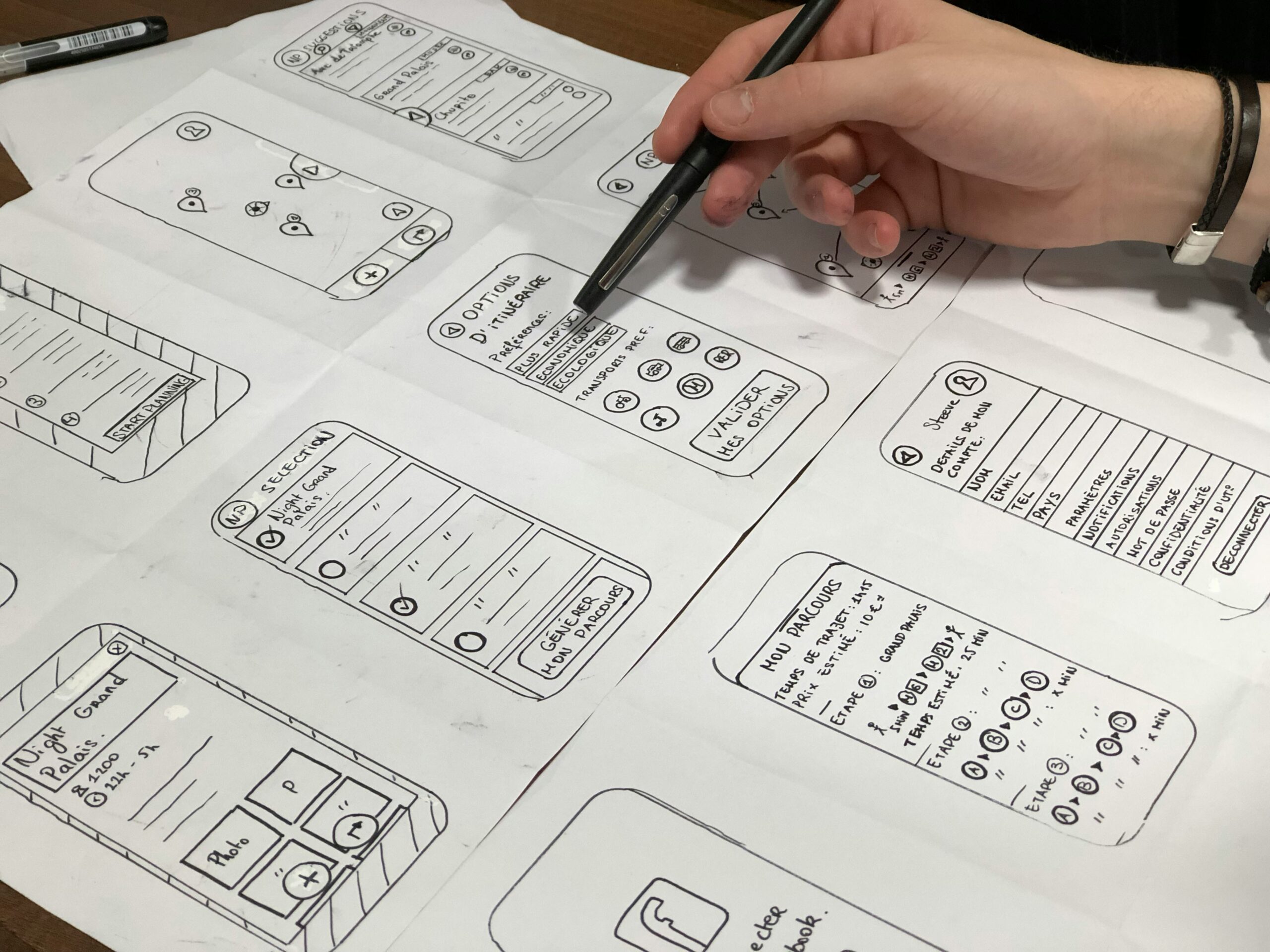

User interface (UI) refers to the visual elements and layout of a digital platform, while user experience (UX) encompasses the overall interaction and satisfaction of users with the platform. In modern banking, UI/UX design plays a crucial role in attracting and retaining customers. By creating intuitive and user-friendly interfaces, banks can streamline their financial services and enhance the overall customer experience.

Simplifying Complex Processes:

Traditional banking processes can be complex and overwhelming for customers. However, with well-designed UI/UX, banks can simplify these processes and make them more accessible to users. For example, online banking platforms often provide clear and concise navigation menus, allowing customers to easily find the services they need. Additionally, intuitive UI/UX design can guide users through complex transactions, making them feel confident in their banking activities.

Enhancing Accessibility:

UI/UX design also plays a significant role in enhancing accessibility for all users. Banks strive to create inclusive digital platforms that cater to the needs of individuals with disabilities or limited technological proficiency. Features such as adjustable font sizes, color contrast options, and voice-guided navigation can make banking services more accessible to a wider range of users. By prioritizing accessibility in UI/UX design, banks demonstrate their commitment to serving all customers.

Improving Mobile Banking Experience:

With the rise of smartphones, mobile banking has become increasingly popular. UI/UX design plays a crucial role in delivering a seamless mobile banking experience. Mobile banking apps are designed to be user-friendly, with intuitive navigation and touch-friendly interfaces. By optimizing the UI/UX for mobile devices, banks make it convenient for customers to access their accounts, make transactions, and manage their finances on the go.

Personalization and Customization:

UI/UX design allows banks to provide personalized experiences to their customers. By analyzing user data and preferences, banks can tailor their digital platforms to meet individual needs. For example, customers may receive personalized recommendations based on their spending habits or be presented with relevant financial products and services. This personalization not only enhances the user experience but also strengthens the relationship between the bank and its customers.

Security and Trust:

In the world of banking, security is of utmost importance. UI/UX design can play a significant role in building trust and ensuring the security of customers’ financial information. Banks invest in creating interfaces that convey a sense of trustworthiness and employ security measures such as two-factor authentication and biometric verification. By prioritizing security in UI/UX design, banks instill confidence in their customers and encourage them to engage in digital banking.

Continuous Improvement:

UI/UX design is not a one-time effort but an ongoing process. Banks continuously gather user feedback and analyze data to improve their digital platforms. This iterative approach allows banks to identify pain points, address usability issues, and introduce new features that align with customer needs. By embracing user-centered design principles, banks can stay ahead of the competition and provide innovative banking solutions.

Conclusion:

UI/UX design has revolutionized the banking industry by streamlining financial services and enhancing the customer experience. Through intuitive interfaces, simplified processes, and personalized experiences, banks can meet the evolving needs of their customers. By continuously improving their digital platforms, banks can stay at the forefront of modern banking and ensure that their customers have access to convenient, secure, and user-friendly financial services.

Leave a Reply